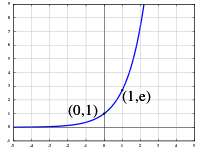

Governments of the world’s leading economies have more than $7.6 trillion of debt maturing this year, with most facing a rise in borrowing costs. Led by Japan’s $3 trillion and the U.S.’s $2.8 trillion, the amount coming due for the Group of Seven nations and Brazil, Russia, India and China is up from $7.4 trillion at this time last year, according to data compiled by Bloomberg. Ten-year bond yields will be higher by year-end for at least seven of the countries, forecasts show.That, from Bloomberg.com. What does it really say? It says WE'RE FOOKED. That's what. Why? Because the world's "strongest" economies, that is, those that are not part of the dirt-floored, malaria invested, man-eat-man, drug-dealing 3rd world, are in BIG FRICKING TROUBLE. You see debt can't be IGNORED as we are doing now. It must be not only paid back - that you can take your time doing - but paid DOWN, as you must SERVICE your debt. What does "service" mean? It means PAYING INTEREST on the debt. When you borrow money, whether you're a person or a government, or a bank, you do it AT INTEREST, i.e. by paying back MORE than you borrowed and that interest is due at regular intervals. The U.S., and most of Europe have borrowed so much they will soon have trouble EVEN PAYING THE INTEREST on their debt. Interest compounds on itself - it is an EXPONENTIAL FUNCTION. And over time it looks like this:

Greece already had this problem. Next up is Spain and Italy. Spain is in a depression and Italy is half-way into one. So while their economies are SHRINKING and the government is taking in LESS money, their debt costs (interest payments) are climbing as everyone realizes the countries CAN'T EVEN SERVICE THEIR DEBT. So what you say? What does that matter? Well, thanks to the international banking cartel, when a handful of banks loan Italy and Greece a few hundred billion, when they lose that money (its already lost, trust me), their losses spill over to the people they owe money to - including the Asian and American banks. This spillover effect is being called a "financial crises." The only crisis is too many people doing the same thing - lending to each other and lending to the bankrupt, whether it be bankrupt people for a mortgage or bankrupt countries who want to piss the money away on programs or giveaways to the wealthy. EITHER WAY its someone spending LOTS of money that is BORROWED AT INTEREST. How does this end?

Well, historically, after the banks all fail (ours are insolvent, but not yet out of business), the governments all bail them out and then borrow and print money to "stimulate" the economy. Then the value of the currencies (dollar, yen, etc.) they are printing all fall (when you make more of something it is thereby worth less... until it is worthless) until the cost of goods - oil, gold, silver, etc. soars in value and no one can afford to buy half of what they once did because their money is worth so much less, so sales of everything are cut in half and entire continental economies collapse, followed shortly by world war.

Governments aren't "stimulating" anything. They are trying to cover up the fraud that poured billions into the economy and bailout the fraudsters who are trying to cover up their debts and stay in business (banks and insurance companies mainly). When people question this obvious duplicity and criminal behavior, the politicians demand "YOU will all starve if we DON'T do this!" We won't. Its an empty threat. The stock market will crash badly and the government will no longer be able to afford to pay themselves lavish salaries or be so enormous we need another 3 economies to support it, and the price of things would fall, perhaps even your salary, but life would go on with a SUSTAINABLE economic foundation. Instead, they maintain the farce that is our economy and print money and pray things will "magically get better."

There is no Santa Claus. Not for little kids and not for the U.S. Government. Europe and the U.S. cannot afford to pay its debts back and will both default or print money until the money is worthless. Period. Eventually the government will ban all wire transfers of money overseas and they will ban the ownership of gold in a desperate attempt to keep the ponzi scheme alive. They did this during the Great Depression as well. It failed then, it will fail now.

We, ahem, THEY, are fixing nothing, doing nothing, preventing nothing. They are simply engaged in one coverup after another. They couldn't care less about you, me, or baby Jesus. They are here to blow out the country, the taxpayers and help themselves and their friends in the process. They don't care how much it costs or who pays for it just so long as they get their money and get out. America has been turned into one big scam. The children pay for it, the crooked adults run it and in the end everything falls apart. Its called the id. It brings everything down.

Again we, THE PEOPLE, will clean it all up and start all over, hopefully after hanging some of these criminals on the court house steps.

No comments:

Post a Comment